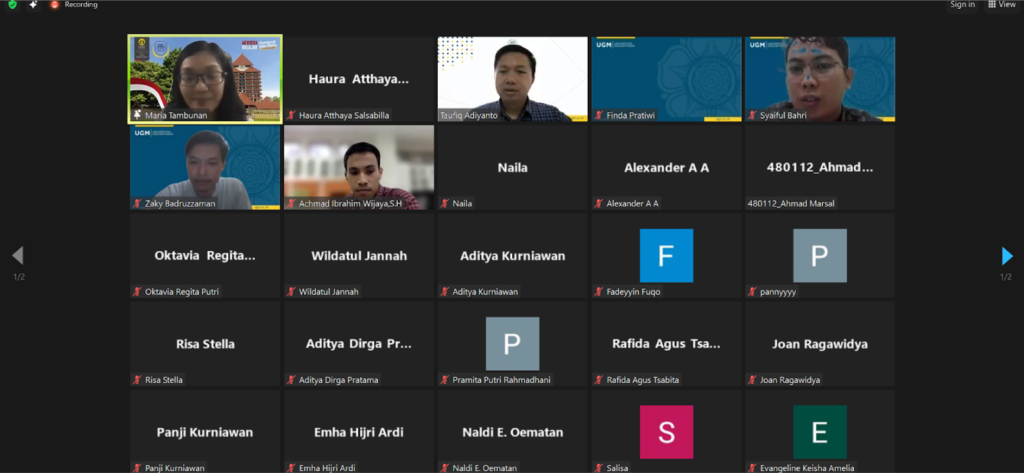

On Wednesday (29/5/2024), the Tax Law Department of Faculty of Law UGM organized a guest lecture for the International Tax Law course, which was attended by 30 students via the Zoom application. This online event aimed to enhance students' understanding of international tax issues, particularly in the context of the Sustainable Development Goals (SDGs) related to education.

The theme of the guest lecture was "The Implications of Global Minimum Tax for Indonesia," featuring Dr. Maria R.U.D. Tambunan, S.I.A., M.E., a lecturer from the Department of Fiscal Administration at the University of Indonesia. Dr. Tambunan is well-known for her expertise in tax policy and has contributed significantly to discussions on international taxation.

During her presentation, Dr. Tambunan provided an introduction to the Global Minimum Tax (GMT), explaining its significance in the current global tax landscape. She discussed the concept of tax competition, which serves as the backdrop for the introduction of GMT, highlighting how countries have historically competed to attract foreign investment through lower tax rates.

Furthermore, Dr. Tambunan stressed the importance of innovation in tax incentives for multinational companies as a proactive measure against the challenges posed by GMT. She argued that Indonesia must adapt its tax policies to remain competitive and attract foreign investment while ensuring compliance with international standards.

The guest lecture concluded with an interactive question-and-answer session, where participants actively engaged in discussions. The main topics of conversation revolved around the implications of GMT for tax incentives in the new capital city, Nusantara, and in Special Economic Zones (KEK).

This guest lecture is expected to enrich the participants' knowledge in the International Tax course, especially regarding issues related to double taxation avoidance and the Global Minimum Tax. The Tax Law Department aims to continue providing such educational opportunities to foster a deeper understanding of complex tax issues among students.

In conclusion, the guest lecture by Dr. Maria Tambunan not only provided valuable information but also encouraged critical thinking about the future of tax policy in Indonesia. The Tax Law Department remains committed to promoting education that aligns with the SDGs, particularly in the realm of international taxation.

Author: Fadeyyin Fuqoha Akbar (Part Timer of Tax Law Department)

Editor: PR